Building a Solid Foundation for Your Financial Future: A Personal and Professional Journey

Aloha Beautiful Souls,

I trust you had a joyous holiday season and that the dawn of 2024 has ushered in a wealth of positivity for each of you. After savoring precious holiday moments with my son and granddaughter, I embarked on a transformative 25-day healing pilgrimage to India, finding solace at the Rajah Ayurveda Clinic. While the journey was arduous, the experience was priceless.

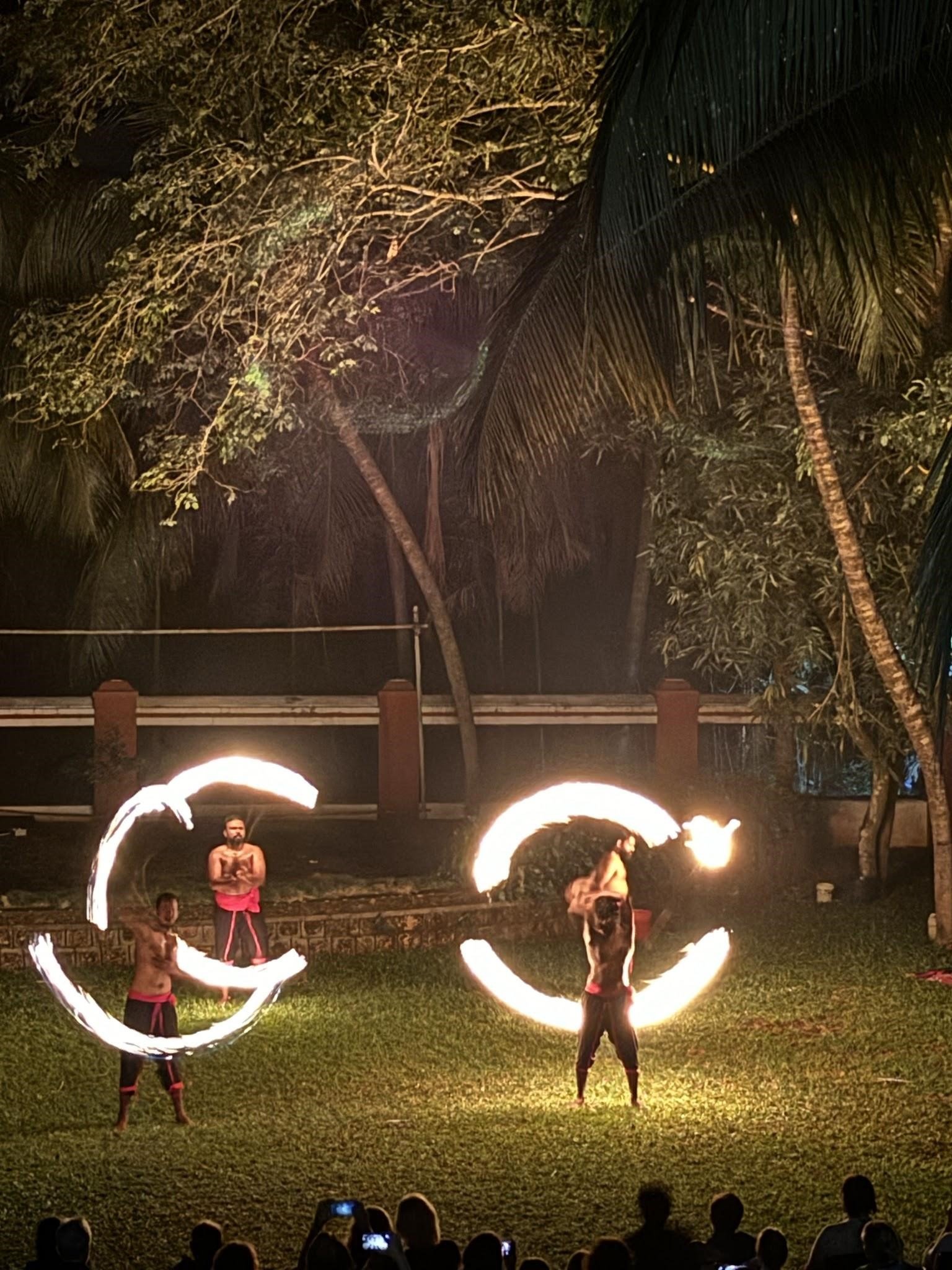

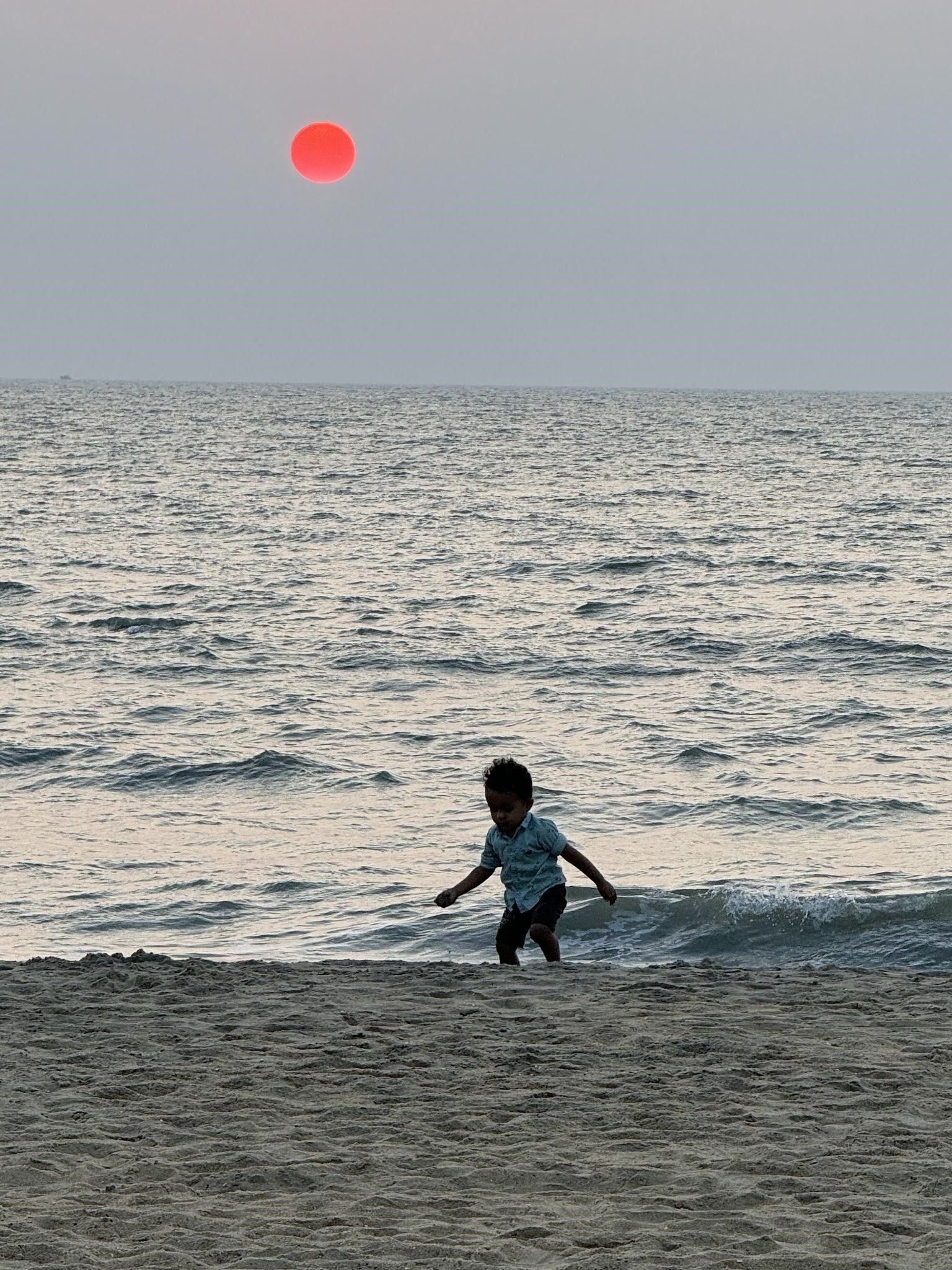

My heart swells with tales to tell, but for now, I'll let the captivating photos weave their own narratives. India, a captivating land suspended in a time warp, revealed both its enchanting beauty and the stark reality of the financial struggle endured by many. As I often proclaim, health is our greatest wealth, yet financial stability empowers us to meet our basic needs and beyond. In this blog, I touch upon the journey of financial empowerment, exploring how personal and professional confidence can be the catalysts for securing our financial well-being.

Amidst the chaos of our daily lives, a fundamental element often slips through the cracks, wielding a profound impact on our overall well-being–our financial health. As I've long maintained, while our health undeniably stands as our paramount wealth, it's the bedrock of financial security that ensures the delicate equilibrium of our existence.

I touch upon valuable insights into attaining the tranquility that accompanies a well-crafted financial plan. I will take our 💰net worth to another level on this week's edition of ‘A Dose of Positivity,' I'm thrilled to bring you the wisdom of JaRee Bowers, the Executive Vice President at Five Rings Financial. Join us as she unlocks the gateway to financial security, a pathway that fortifies our financial landscape and contributes to a more secure and resilient well-being. Get ready for a dose of positivity that transcends monetary values, delving into empowerment and peace of mind.

Join us for an uplifting discussion on Thursday, February 8th, at 7 pm EST

Here's the Zoom link: http://bit.ly/3Z31uMH

In the meantime, let me pose a question to you: How are you building a solid foundation for your financial future? It's a question that often lingers in the back of our minds, yet many of us find ourselves navigating the complexities of personal finance without a clear roadmap. The truth is that creating a robust and enduring financial foundation requires intention, dedication, and a bit of financial literacy.

As someone who values the importance of financial empowerment, I've come to realize that having a firm grip on your finances positively impacts your physical and mental well-being. The confidence that stems from financial security is unparalleled, and it starts with safeguarding what you already possess.

💰Consider your income–the lifeblood of your financial world. Are you taking steps to secure it? Life is unpredictable, and unexpected twists can disrupt our earning potential. A safety net, such as an emergency fund, can cushion you during challenging times, allowing you to weather the storm without compromising your financial stability.

💰Retirement savings is a subject that often gets pushed to the back burner. Building a nest egg for your golden years is not just a luxury; it's a necessity. Imagine the peace of mind that comes with knowing you've laid the groundwork for a comfortable retirement. Whether through employer-sponsored plans or individual retirement accounts, taking advantage of these opportunities today sets the stage for a financially secure tomorrow.

💰If you're a homeowner or a business owner, you understand the significant investment tied to these assets. Protecting your home and business is not just a matter of financial security; it's a testament to your hard work and dedication. Explore insurance options and risk management strategies to ensure unforeseen circumstances don't jeopardize what you've worked hard to build.

💰Your loved ones–the beating heart of your life. What security measures do you have in place for them? Life insurance, estate planning, and a well-thought-out will are not just for the wealthy. They're tools that provide peace of mind, ensuring that your loved ones are cared for in the event of the unexpected.

💰In my journey towards financial well-being, I've come to appreciate the transformative power of knowledge. Educate yourself about investment options, understand the basics of budgeting, and be proactive in managing your financial affairs. The more you know, the more confident you can navigate the intricate landscape of personal finance.

Building a solid foundation for your financial future is an ongoing process. It requires regular assessment, adjustments, and a commitment to staying informed. As you reflect on your own financial journey, ask yourself: What security and peace of mind do I have in place for myself and my loved ones?

Those of you reading this post are eligible to do something about your financial well-being, unlike what I saw in India. I urge you to embrace the journey towards financial literacy and empowerment. It's not just about dollars and cents; it's about the freedom and peace of mind that comes with knowing you are in control of your financial destiny. Start today and build a foundation to support you and your loved ones for years.